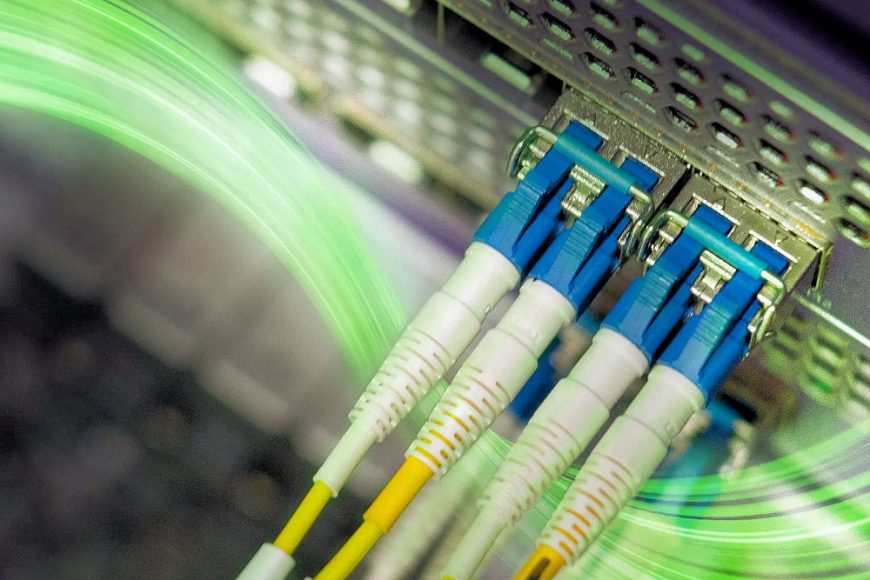

Openreach Add 12 New UK FTTP Broadband Rollout Areas

Network access provider Openreach (BT) has today added 12 new places (towns and villages) to their £15bn rollout of a new 1Gbps Fibre-to-the-Premises (FTTP) broadband ISP network, which also includes a few corrections due to past errors and a larger build on the Isle of Wight. Some 8 million premises are now covered.

The rollout, which has just reached 8 million UK premises (inc. 2.5m in the hardest to reach “final third” of the country), is currently running at a build rate of c.58,000 premises per week and this is predicted to peak at c.75,000 premises at some point in the near future (i.e. up to 4 million premises per year, which compares with the 1.9 million added in 2020/21).

NOTE: Openreach’s goal is to reach 25 million premises (80%+ of the UK) by December 2026 and 6.2 million of those being targeted are in rural and semi-rural areas (here).

A big chunk of the new list – reflecting a total of around 140,000 premises – is taken up with the addition of locations across the Isle of Wight, which resides just off the south coast of Hampshire in England. Openreach were initially only deploying across the East Cowes area, but they’re now expecting to invest £13.5m in order to cover 45,000 premises across the island.

Read the full story here.